End 2022 Review - failing financial goal for the first time, $660k net worth

In end 2021, I shared that I was hitting close to $700k in net worth.

I did. On 1 Jan 2022.

But, things just went downhill from then on.

Here's a recap of my finances over the years:

- 2016 - Unexpected review of 2016: hitting $200k in net worth

- 2017 - End 2017 review - net worth at $287k

- 2018 - End 2018 review - net worth at $372k

- 2019 - End 2019 Review - inching close to $500k net worth (~$440k)

- 2020 - End 2020 Review - net worth at $550k

- 2021 - End 2021 Review - closing in to $700k net worth

Targets review:

These were what I set out for 2022:

- Aim to achieve $850k net worth in 2022❌

- Bring my parents out for an overseas trip; if not make do with cruise trip❌

- Grow crypto portfolio to 10% of networth❌

- Material wants: buy a rolex and LV/chanel bag✅ (no rolex or chanel, but a LV)

2022 Review

Here's a recap of what went by in 2022:

Jan

- Started the year with $8728.48 in CPF interest

- Made my first CPF top up of $3k to MA in 2022

- Shared I had $17k passive income for year of 2021

- Had my covid booster shot

- Pumped some money in Anchor Protocol

- Did my second fertility treatment, which failed

- Shared that I've depleting cash, which is still the same as at today (Dec 2022)

- Started on SRS with Endowus

- Shared my insecurities at work

Feb

- Received $100 reward from DBS for SRS sign-up

- Failed my third fertility treatment

- Family has gotten covid

Mar

- Surrendered my etiqa 2.02% 3-year endowment

- Did the 16 personality quiz and found out I'm ISFP-T

Apr

- Travelled to Europe and realised Luna went to $0. Net-worth taking a beating

Jun

Jul

Sep

- Signed up for Trust and was happy with the free NTUC vouchers as sign-up bonus!

- Redeemed free breakfast set with Trust (I love free stuff!)

- Calculated that I'm spending ~$500 per month on my health

- Got a couple of calls for interview, there's still hope for me

Oct

- Signed up for Tiq 3-year endowment at 3.60%. Within a few weeks, it has risen to 3.95%

Dec

- Shared that it's a shitty 2022

- Took my additional booster shot

To sum up 2022:

- I paid tons of money on fertility treatments and embarked on the the most painful (physically, mentally and for my pockets) - IVF. The worst? Seeing no result despite the money and efforts poured.

- Stocks, crypto crashed which means a beating on my net worth. Income received couldn't cover the losses.

- The best thing that happened was a new job, with a better compensation. I hope the 2023 recession won't affect my rice bowl.

Net Worth

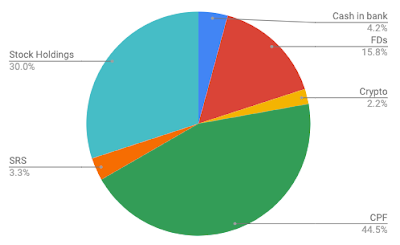

And with that, something everyone is here for...my networth at $660k, a $30k drop compared to 2021. This made it seemed that I earn nothing from my employment, interests from bank, reits etc, and cpf.

If my stock and crypto remained at the level of 2021, I'd have $750k in 2022. Still not a lot compared to my usual growth.

If only I continued my conservative way of purely saving money, and not investing in stocks or crypto.

If only.

Hopes and Goal for 2023

In end 2021, I spoke about how I've come to terms about not having a child. It's a constant struggle because I get disappointed every single month. I decided that while I am still in my early 30s, I should take a gamble and proceeded with IVF. It was an abrupt decision - what I needed was time and money. Wrt money, I had to set aside >$30k, which isn't a small sum but I'm thankful I have the means. Wrt time, I had to sacrifice work; I had to bite the bullet and face the consequences of incurring wrath from unsympathetic bosses.

I was prepared to give up my time and money.

But it broke me (literally) when I failed.

Maybe I didn't build my body well enough, for my decision to do IVF was sudden. I thought I had a chance to witness a positive result, before the end of 2o22. But it wasn't meant to be.

In end 2021, I also spoke about how work is just a means. It still is. But this time, I feel more motivated to be seen as a strong worker, so that my job is protected from any retrenchments. This means, I need to work smart and not quiet quit. I hope my motivation don't lose steam mid-way next year.

I still aspire to retire at 40 though.

Here's setting 2023 goals and reusing 2022 ones that I failed to meet:

- Aim to achieve $850k net worth in 2023, the exact goal as 2022

- Bring my parents out for an overseas trip

- To do well in my new job

And lastly, a vision board for 2023. Can you guess what it's about?

With that, I'm closing 2022 and praying for better luck in 2023.

Comments

Post a Comment

No rude messages please. Unkind messages and spams will be blocked and deleted.