Trust cards are here and what I've redeemed 😊

Look what came in my mailbox today!

Presenting 2 versions of Trust card - one for NTUC Union member and the blue trust card for non-member

Honestly, I could do without the cards as we've stored the digital card in our apple wallets.

What we've redeemed

- Anyway, we've redeemed our FREE 1kg rice - which was tough to find btw. Take note that this voucher expires first and you need to click "Coupon" at self-check out counter and scan barcode to redeem.

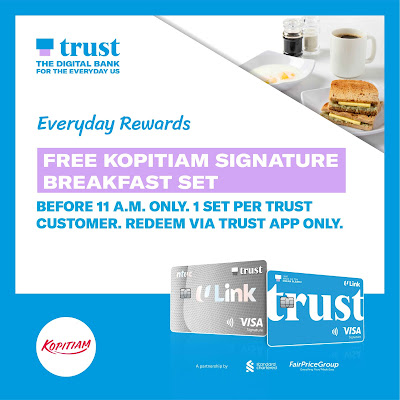

- Also, our FREE kopitiam breakfast set. The auntie was very kind and allowed me to top up 20 cents for milo. All you need to do is to go to your coupon, click "Redeem", key in the code that the staff tells you and show it to them.

Take note the voucher expires 31 Oct 2022 and the set is only available before 11am #fortheearlybirds

- I've also redeemed my sign-up reward of $10 fairprice e-voucher for my grocery shopping! At the self checkout counter, click “All Other Payments” and scan your voucher's barcode.

If you'd like to receive these freebies, the registration details can be found in my previous blog post.

Have you redeemed yours?

Comments

Post a Comment

No rude messages please. Unkind messages and spams will be blocked and deleted.