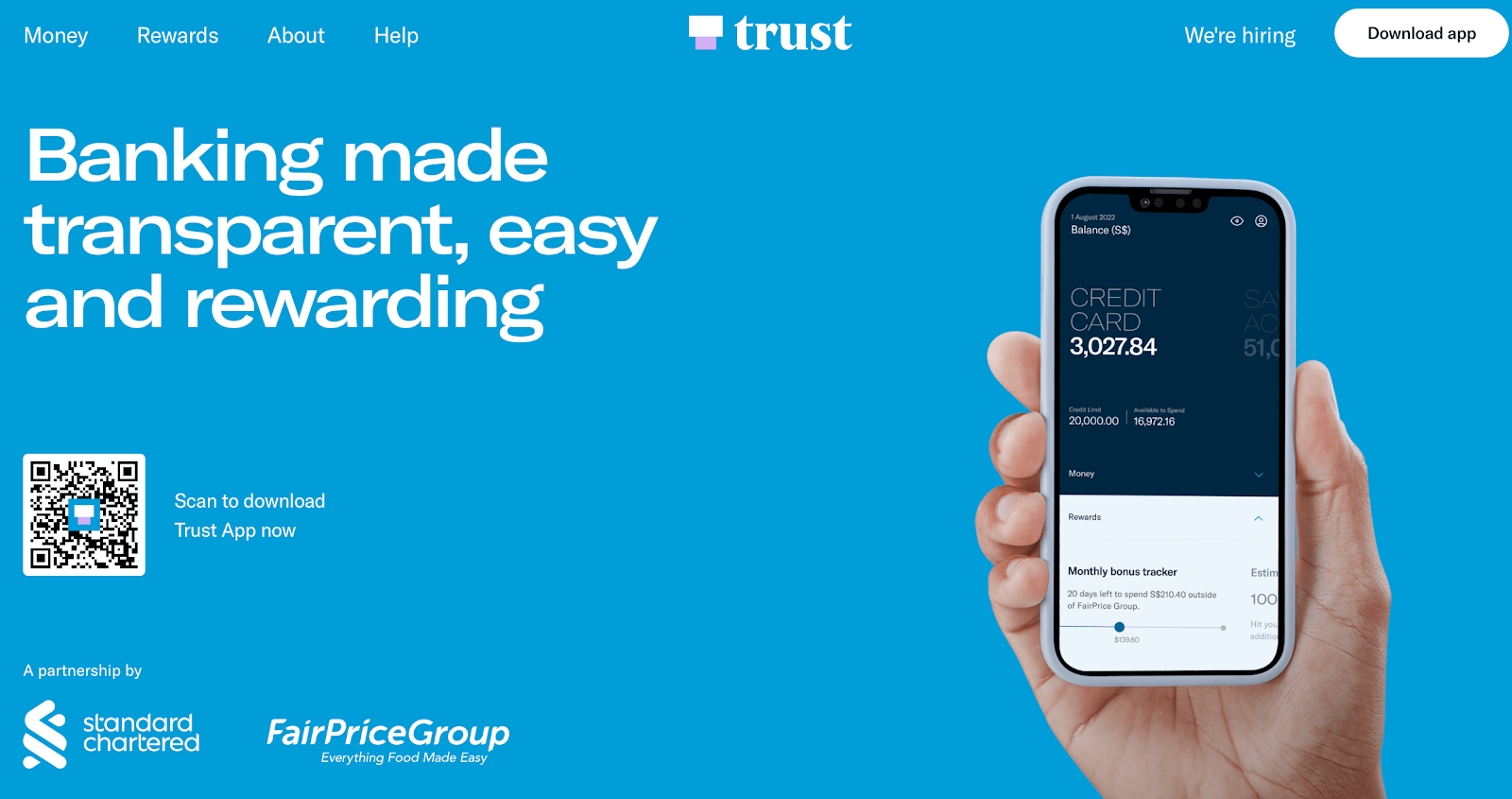

Registration steps for Trust Bank App and how to unlock Fairprice e-vouchers, chance to win a Tesla and other vouchers!

It's been long since I saw so much hype in the blogosphere given the sour macro environment. After reading a few articles and realising the perks without doing much, I decided to sign up for a Trust account. Read on for more about the perks! PS: easy, $35 fairprice e-vouchers combined, 1kg rice, free breakfast set at kopitiam, chance to win Tesla and more!

Registration steps

Sign-up was fuss free. Here're the steps:

- Download the Trust Bank app - you can head to this link to scan the QR code or scan from the above image

- Click "Use referral code" to get $10 Fairprice e-voucher. You can use your friends or mine i.e AP1PJBRK if you don't have a code. 😊

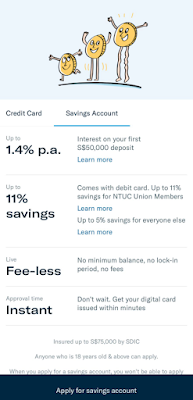

3. Click "Apply for savings account"

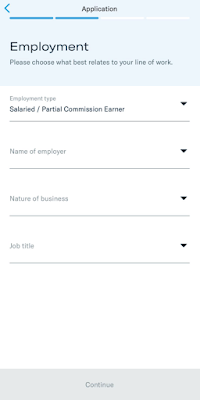

4. Sign up using "myinfo" and it will extract info from your Singpass.

5. Some of the information you need to key in are Employment Type, Name of Employer, Nature of business, Job Title , whether you are a tax resident of Singapore, and how you want the name on card to be (it's fixed as your name as per IC. No preferred name allowed)

6. Key in your preferred 6-digit passcode

7. [For iphone users] Link your trust card with apple pay!

And you're done!

Rewards and how to unlock them

There are multiple rewards split into:

A) Sign-up reward

B) Spending reward

C) Free coupons

D) Chance to win Tesla

A) Sign-up reward

- Sign-up with referral code gets you $10 Fairprice e-voucher

- All sign-ups will net you

- 1kg rice

- Kopitiam breakfast set

- You should see these 3 rewards:

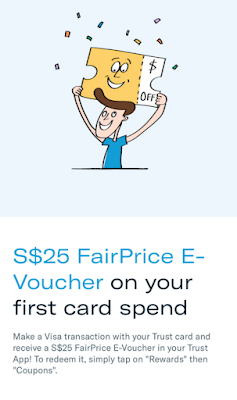

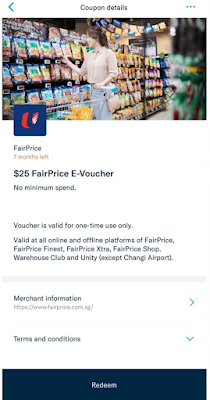

- Spend any amount on your first card spend to get $25 fairprice e-voucher

- To get this, you'd need to

- Transfer $ to your Trust Bank

- Make payment on any item via your Digital Bank card

- And voila...instant notification that my $25 fairprice e-voucher is in

- The e-voucher will come in QR code which you can scan at Fairprice cashier

C) Free Coupons

- Head to Rewards > Coupons and you'll see featured coupons and save them

- Some of the coupons useful for me are:

- 50% off KFC Zinger Box

- $1.99 Burger King double mushroom swiss burger

D) Chance to win a Tesla

- You'll get 1 chance when you successfully sign up

- And more chances for each successful referral!

- See more details here: https://www.trustbank.sg/tesla/

I know my family is excited about the freebies! Are you?

Have fun getting the perks while it lasts!

(info accurate as of 4 Sept)

Comments

Post a Comment

No rude messages please. Unkind messages and spams will be blocked and deleted.