Aug updates - Quiet quitting, CPF top up made, SSB Sep 2022

Work

1 year into my role and I'm jaded. I guess I'll never find a job I'm happy with.

But the consolation is that this job is relatively easier than the previous, so I'm just cruising along...until I get fired.

I resonated with the quiet quitting term that's been all over the news recently. I guess I've been quiet quitting all these while. People said it's a term for cruising, doing the minimum, or performing at your payscale. I've always been the type who knock off on time, though I am more enthusiastic in my first few work years. Somehow, my bosses acknowledge my efforts and I don't have to wayang. As I grow older in my career, things change. Because of how "quiet" I am, I may not get into the good books of bosses. I don't talk to bosses nor bother talking to colleagues to showcase what I'm doing. I don't bother to wayang. I don't bother suggesting ideas to improve work - I did try recently, but it backfired. I'm better off staying quiet.

The downside is, I gain nothing out of this role except the income. I dont gain new skills and I feel I'll have difficulties jumping to the next job. As I said previously, I'd get too expensive to hire. Young talents would be a better bet since they'd be more eager and are cheaper.

Anyway, I don't want to think too much. Work is work. I will just move with the flow.

CPF top up

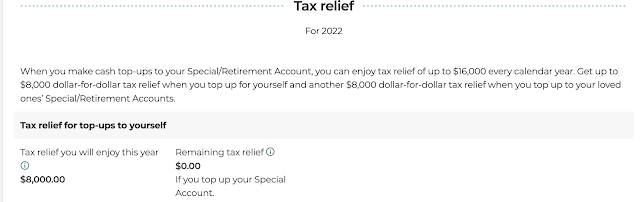

There's nothing interesting this month. On financial front, I just made a CPF top up today of $4,344 into my SA. Why this odd amount? Because I did a $3,000 top up to my MA in Jan 2022, and $656 top up to my MA in Apr 2022 when my NTUC Incomeshield plan deducted $ from my CPF MA.

I also realised CPF made quite a few changes to their website. Somehow, I prefer the older version - lesser words, which makes it easier for me to zoom in on the info eg. how much I have and how much I've topped up. The new changes show more wordings, as seen below. It gets quite tiring on the eyes when I see so many words. In gist, I've max out my $8,000 top-up for 2022 on 30 Aug 2022. #goodjobtomyself

The next step is to top-up another $8k to my mum. In the past, I would top up for her in January. However, I've been getting really cash poor. All because of poor investment mistakes - be it in SG, HK, US stocks or crypto.

I think I've said a couple of times that I use to have $300k cash at my disposal. As of today, I only have $120-130k cash spread across my banks and FDs.

I am now eagerly waiting for each month end/for my pay to come in. That feeling kinda sucks. I will try to top up her account by Dec 2022, or when I feel my DBS Multiplier has enough cash....currently I only have $30k inside 🙃 a far cry from $100k in my muliplier.

Sep 2022 SSB

I also balloted for the Sep 2022 SSB and put in $10k. Managed to get the full allotment.

Other than that, there's nothing to shout about these 2 months.

Health

I've been trying to grow my money but it's not working out. Stocks and crypto just kept going south. I've also been spending a lot on more my health. I started going for TCM acupuncture, in hopes to strengthen my body and for miracles to happen. Signed a package for 4 digit sum, and hopefully I'd see fruits from this treatment. I've also been buying supplements, and tonics.

Health maintenance doesn't come cheap.

Net Worth

Something most people would wanna kaypo about - standing at ~$679k, no improvement compared to Jul...

It's pathetic that I'd be much richer if I did not buy stocks, crypto nor use my CPF to invest in endowus. Anyway, will psych myself that these are for long-term....

Till then.

Hi.

ReplyDeleteTake it easy.

May I know how old are you ?

She mentioned she was 25 when achieving 100k cash savings in her 2016 review. So I think she was born in 1991. So in 2022, she should be around 31.

DeleteCrypto sucks..at least for now and for me too. Endowus shd b ok for long term, not sure what funds u bought. If it is an index fund, shd b alright. Cheers.

ReplyDelete