2025 - CPF interest of $13k in

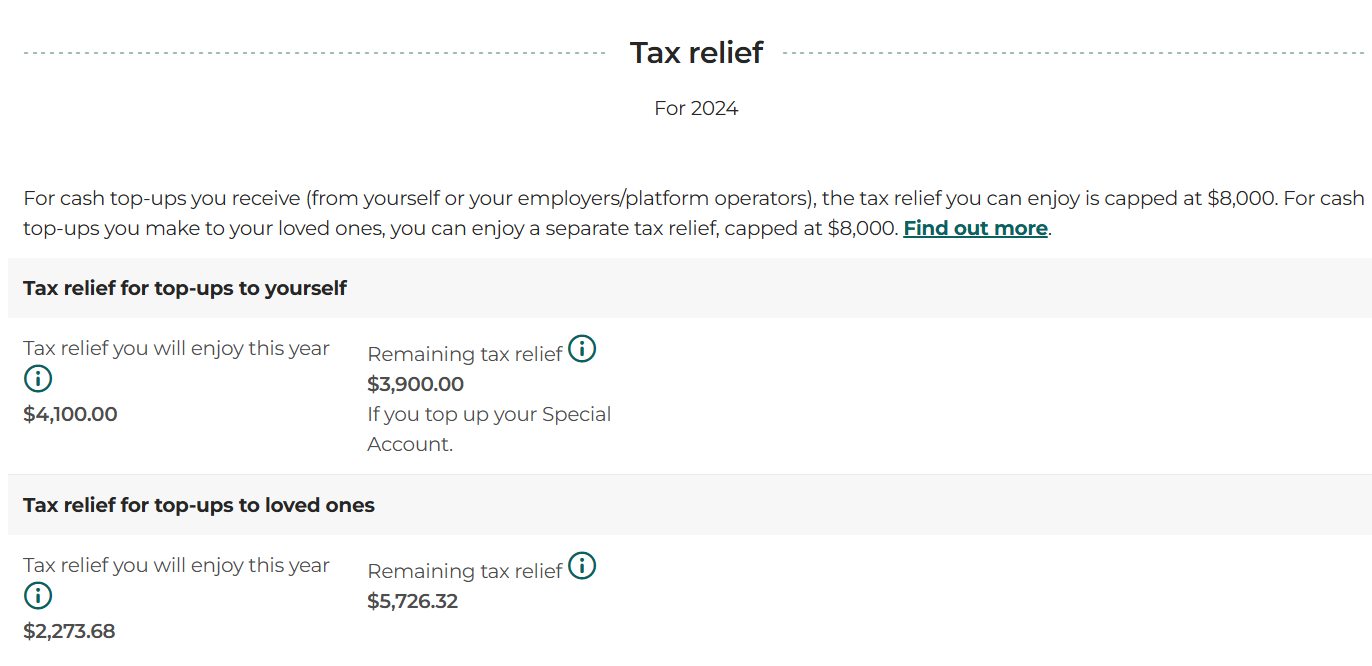

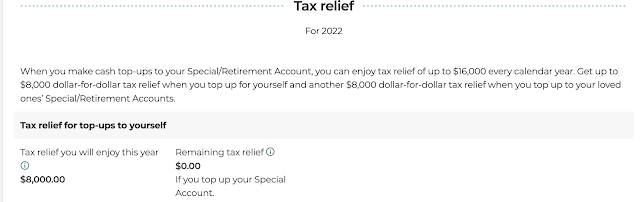

My favourite activity for each start of the year is checking my CPF interest. And on 1 Jan 2025, I've received the following interest: 2025 will also mark the year where I reach FRS of $213,000. This will mean limited tax relief, unless I've deductions from Medisave that can allow $8k top-up. It will also be the year where I receive my CPF OA used for housing, upon the sale of my flat. That said, the amount will likely channel out to my new home (which I'm still hunting for). Overall, I know 2025 is going to be eventful. It is definite that I will get a new home under my name. While cashflow is tight, I'm proud that I am able to scrap through owning a >1m property by my own. Though, servicing another one under my hubby's name will be a headache. Anyway, we will get there. Things are looking rosy and 2025 will be a great year for me!