2024 CPF cash top-up completed

For years, I've done CPF cash top-ups in a bid to reduce taxes. I typically did them at the start of the year.

I had an inkling I wasn't earning a lot to warrant the tax reliefs, but felt compelled to do so to make it seem like my money in CPF was working harder.

Afterall, 4% on SA was much greater than leaving it in the banks. No doubt, these were money "stuck" until I could only withdraw them when I cross 55.

In the past 2 years, I became more apprehensive of topping-up at the start of the year. I only did it for MA, but for SA, I decided to wait...till I had more cash on hand. This was because I was running out of cash reserves as I threw in quite a bit of cash in 2021 onto stocks, cryptos....and unfortunately, was not savvy in making good returns.

I had to rebuild my cash reserves. That meant just aggressively saving, without investing. This may not be the wisest, but I needed comfort and security that my cash nest is being built back to the original state.

Fast forward now, while I still do not have $300k cash that I reported by when I was 30, I'm getting there.

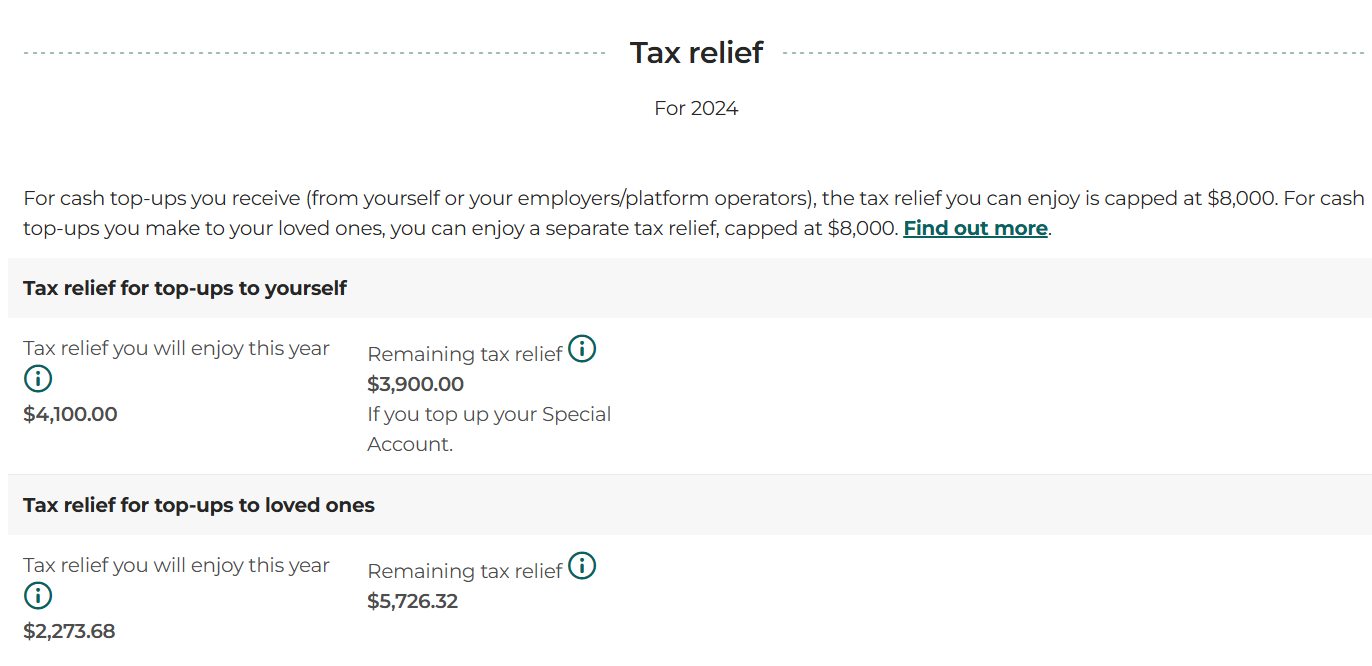

Anyway, back to my main point. It's 22 Dec 2024. I've completed cash top-up to my SA, as well as to my mum. Come 2025, I believe that is my final year of gaining tax relief from cash top-up to both my SA as well as my mum's since we'd hit FRS.

I'd also be making a $15,300 cash top up for SRS.

Till the next update!

Comments

Post a Comment

No rude messages please. Unkind messages and spams will be blocked and deleted.