Topped up $656 cash to CPF MA and $0.15 cash back

Thanks to those who left comments in my earlier post. Appreciate all your kind words.

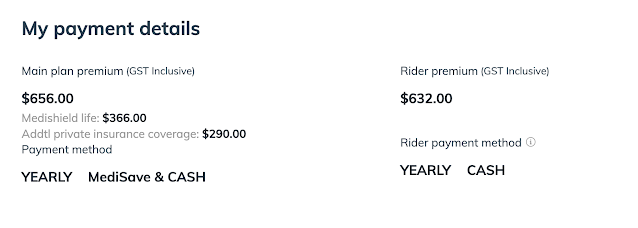

Anyway, time flies and it's another year of insurance payment. I have been on NTUC Enhanced Income Shield Preferred hospitalisation insurance plan with plus rider for many years. Not cheap, but it's a must have for peace of mind.

As part of yearly insurance renewal, my CPF MA was recently charged $656. Since I was previously at the MA ceiling of $66,000, I wanted to maintain this for both 4% CPF interest and to maximise my tax relief. You would have known by now that, each of us are able to top up a maximum of $8,000 per year for your self account to either MA or SA for tax relief.Mistake

I made a mistake of topping up my Grab with UOB Absolute Amex (which gives 1.7% cashback), thinking I can use my grab to top-up to CPF. Turns out this loop has been cut. I already knew of this, but not sure why my pea brain still went ahead without double checking.

Instead...

I top up my CPF MA via Paynow through Google Pay. Just in hopes of getting a little bit of cash back...which I managed to get $0.15 back.

Comments

Post a Comment

No rude messages please. Unkind messages and spams will be blocked and deleted.