End 2020 Review - Crossing half a million net worth at $550k

Since I started blogging here in 2016, I have been doing my own financial review and reflections at the end of the year. It is timely to think about the good and the bad that came and pass.

Here's a recap over the years:

- 2016 - Unexpected review of 2016: hitting $200k in net worth

- 2017 - End 2017 review - net worth at $287k

- 2018 - End 2018 review - net worth at $372k

- 2019 - End 2019 Review - inching close to $500k net worth (~$440k)

I read back again at what happened in 2019 and am so glad I managed to EXPEND ALL MY VACATION LEAVE and travel to 17 cities. Who would have known that I couldn't even go to JB for my usual shopping in 2020?

Back in 2019, I set very generic goals🙄. I supposed since I have already secured a flat of my own, I have already met my basic needs. Goals like aiming for promotion at work is something that I don't really crave because I prefer NOT to have the stress that comes with it. Here's what I wished for 2020 and whether they came true:

- Build my little family - ❌failed

- Treat family well + treat them during overseas outing - Half ✅Half ❌I tried to squeeze in dining treats and angbaos (practical stuff for traditional parents), but couldn't fulfil any travel plans due to Covid

- Be positive and have more confidence - ✅this is so lame. I don't know what I was thinking when I wished for this. I probably had a lot of negative thoughts - mostly due to work. Now that I rarely see colleagues f2f, the negative thoughts reduced quite a bit. ❌but I still lack confidence :P

- Continue to pray for less stress at work and take things easy - ✅I am taking work easy, but at the start of WFH, it was darn stressful having to cope with the changes and making sure ops and processes can still run smoothly virtually

- Stay healthy and happy! - ✅I'm super contented with the WFH arrangements and glad that I've been pretty healthy (despite poor food intake in exchange for convenience, and super sedentary lifestyle)

2020 Review

Here's a recap of what went by in 2020:

- Jan:

- Adulting officially starts. As I moved into my own crib, I had to take charge of household chores and BILLS! This also marks the month I did my yearly $7,000 CPF SA top-up

- Earned ~$1k from carousell

- Feb:

- Reflected on Covid-19 while I was on leave for an interview. Didn't get the role in the end

- Mar:

- Pumped $15k into the stock market - on hindsight, bad move as stocks went EVEN LOWER. PS - I bought SIA, CDL HTrust, Singtel, Keppel Corp, CapitaR China

- On track for 1M65. In fact, my husband and I can probably do 1M50.

- Apr:

- Shared my thoughts on the benefits of WFH and...I love it❤️

- Blogged about affordable household items that SAVED my lazy ass

- May:

- Shared about my unhealthy WFH lifestyle. I think this was when work went SHIT but I kept telling myself WFH is way better than in office where I've to SOCIALISE. I prefer socialising virtually, TYVM.

- Talked about my 8 sources to receive $600-$1,500 income/month. If you are curious how I grow my 💰, look here

- Jun:

- Jumped onto Google Pay bandwagon here. I am still using it for the extra incentives it gives

- Shared my maturing endowment and FD plans which were at 1.85%-2.02% (wah lao, nowadays where to find?!?!?!).

- Jul:

- Was glad I bought some SSB bonds back in the days. (After thoughts - I may cash them out to purchase stocks IF I NEED IT).

- Tried socash for EXTRA CASH too. Also gotten $70 rewards via google pay (I love free money~~~)

- Aug - the month I blogged THE MOST

- Talked about my hubby and my budget skincare routing which cost less than $100 (that can last for more than a year)

- Achievement unlocked - Amazing $300k CASH savings before I hit 30.

- Talked about the breakdown here

- Started my journey into foreign stocks via Tiger Brokers and dedicating multiple articles here:

- Setting new goal of $600k cash by 35 (After thoughts - this may be hard to achieve as I'd be pumping more cash into other investment tools instead of keeping it in low-interest savings accounts)

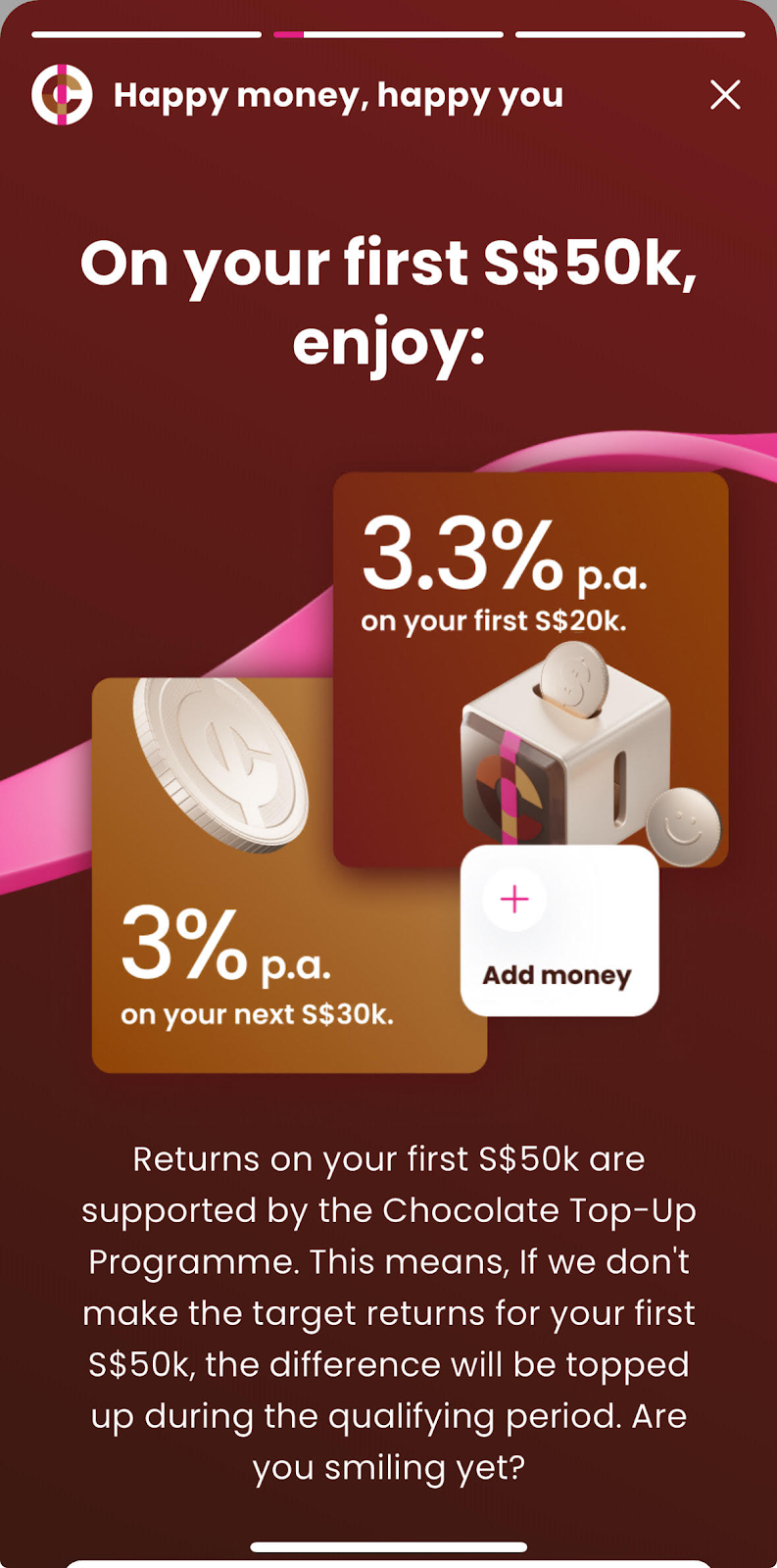

- Joined Singlife for their 2.5% interest for first 10k and 1% for next 90k; pumped more cash into it as I realised I've been stupidly keeping my cash in CIMB for less than 1% interest

- Sep:

- pumped $28k into HKEX and SGX via Tiger Brokers and compared fees with DBS Vickers Cash Upfront Account

- Talked about making my will online for FREE (BUT I've nobody to help me sign as witness 🤦♀️)

- Profited USD$110 from selling Tesla (yup, I'm a donkey.)

- Oct:

- Lucky day as I got a $6.59 rewards from Google Pay!

- Spoke about getting $500-$900/month from May to Sep and how I've pumped in $50k into stocks within 2 months 😛

- Reached $100k stock portfolio value after 6 years (my first foray into stock was 2014)

- Nov:

- Used Google Pay for donations. In the midst of the pandemic, please donate when you can, be it to charity organisations or people directly in need. I generally give a small sum when I walked past tissue sellers or people asking for money. You could see the lit in their eyes even though the amount I gave was not a lot. I still have a lot to learn in giving - compared to my brother who does volunteer work, I have only been giving my part via cash donations.

- Taobao-ed during 11.11 and bought Alibaba stock

- Talked about how 2020 is the year I really started to invest via traded equities, all because of the ease and affordable fees of Tiger Brokers and earning $970 profit this year in stocks.

Net worth

Likely the most interesting topic of this post.

Can I say I'm half a millionaire already? 🎉🎉🎉

This is the breakdown of my $550k networth. I'm still heavy on liquid cash, but have progressively build up my stocks portfolio to a 6 digits figure. This is not including my >half a mil apartment:

Hopes and Goal for 2021

- Aim to achieve $650k net worth in 2021

- Grow my stock portfolio to $200k value

- Get to travel FAR in 2021

- Have a kid

- Be healthy and happy; likewise for my family

Comments

Post a Comment

No rude messages please. Unkind messages and spams will be blocked and deleted.