$500-$900/month passive income (May - Sep 2020) and $50k pumped in stocks since Aug 2020

I've previously shared about my 8 sources to get a decent passive income here.

Broadly, it's due to:

- Stock dividends

- Savings accounts such as Etiqa and Singlife

- Surveys

- Selling items

I shall not repeat my sharing as you can head over to my link 😉

Since May till Sep, I've been getting $500-$900 passive income. Though I must add that it has been long since I cash out my survey (check out milieu app - see point 6) as I need a sizeable point + I dont have much to sell on carousell now.

Given the current economic situation, interest rates have been dropping. On one side, it's good news for my housing loan as I've changed to a bank loan; but on the other hand, as I'm cash-heavy, I don't have much platforms to park my cash.

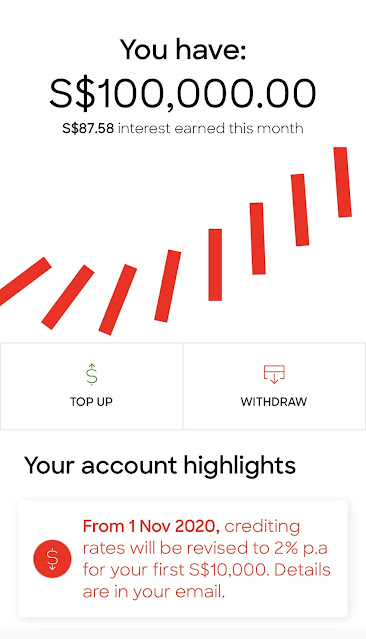

So earlier, I've only park $10k in Singlife to earn 2.5% interest. I decided to up it to $100k to enjoy 1% on the next $90k. Unfortunately, even the 2.5% will now be nerfed to 2%.

Sigh

This is the last month where I'd see 2.5% interest for Singlife first 10k.

While I am still looking out for platforms to park my cash, I've been investing more, especially since I opened my Tiger Brokers account in August and dabbled into HKEX and NYSE. Thus far, I've pumped:

- $28k in late Aug 2020

- Up it to $40k in Sep 2020

- As of today (Oct), and in a span of 2 months, I pumped in close to $50k.

Despite a $100k stock portfolio value, my projected yield is at 4.8% for the next 12 months. It is definitely not enough to get by if I want to #firemyboss

I am now regretting not starting the investment journey earlier and can only look with envy on peers with a $500k-600k portfolio 😢

I was too focused on saving CASH and had saved $300k cash and it gave me a strong sense of security. But I guess this war chest gave me huge flexibility to pump $50k within 2 months into the market. No doubt the market is volatile now with no end in sight, but I shall believe in this quote:

PS: if you are keen to explore Tiger Brokers and you'd like to receive stock vouchers to offset your stocks purchases, kindly use my referral link, code (SBSL8) or scan the QR code to sign up😊 You can refer to step 5 here on how to receive the stock voucher. Thanks in advance for your support!

Comments

Post a Comment

No rude messages please. Unkind messages and spams will be blocked and deleted.