Budget Tracking : Feb 2016

Before I start, sharing this quote I came across from the internet that resonates with me:

In the month of Chinese New Year, I felt like I gained more than I spent because of the angbaos I received. Hehe. But, I'm not sure if this is the 2nd last time I'm going to get my angbaos because I want to get married soon! Argh, gotta discuss more with my bf. Right now, we're just too passive.

Variable expenses: $1,304.69

- Food - $161

- Mainly weekday lunches and a few dates and treats for and with my bf

- Shopping & Misc - $566.45

- 1 blogshop dress, NTUC shopping, a Groupon deal & Oakley sunglasses for my bf etc

- $$$ to my mom for her birthday, health checkup, $10 TOTO (got 3 rows with 2 numbers T.T), and visit to the TCM because of my really weak stomach. Any recommendations for good sinseh? Foresee spending more on Misc for such health visits, but I hope it's worth it.

- Travel expenses - $477.24

- $448.64 for 3D2N Bangkok trip

- $28.60 for Travel Insurance (after a 45% discount)

- Transport/Ez-reload - $100

Variable Earnings (not including salary): $937.78

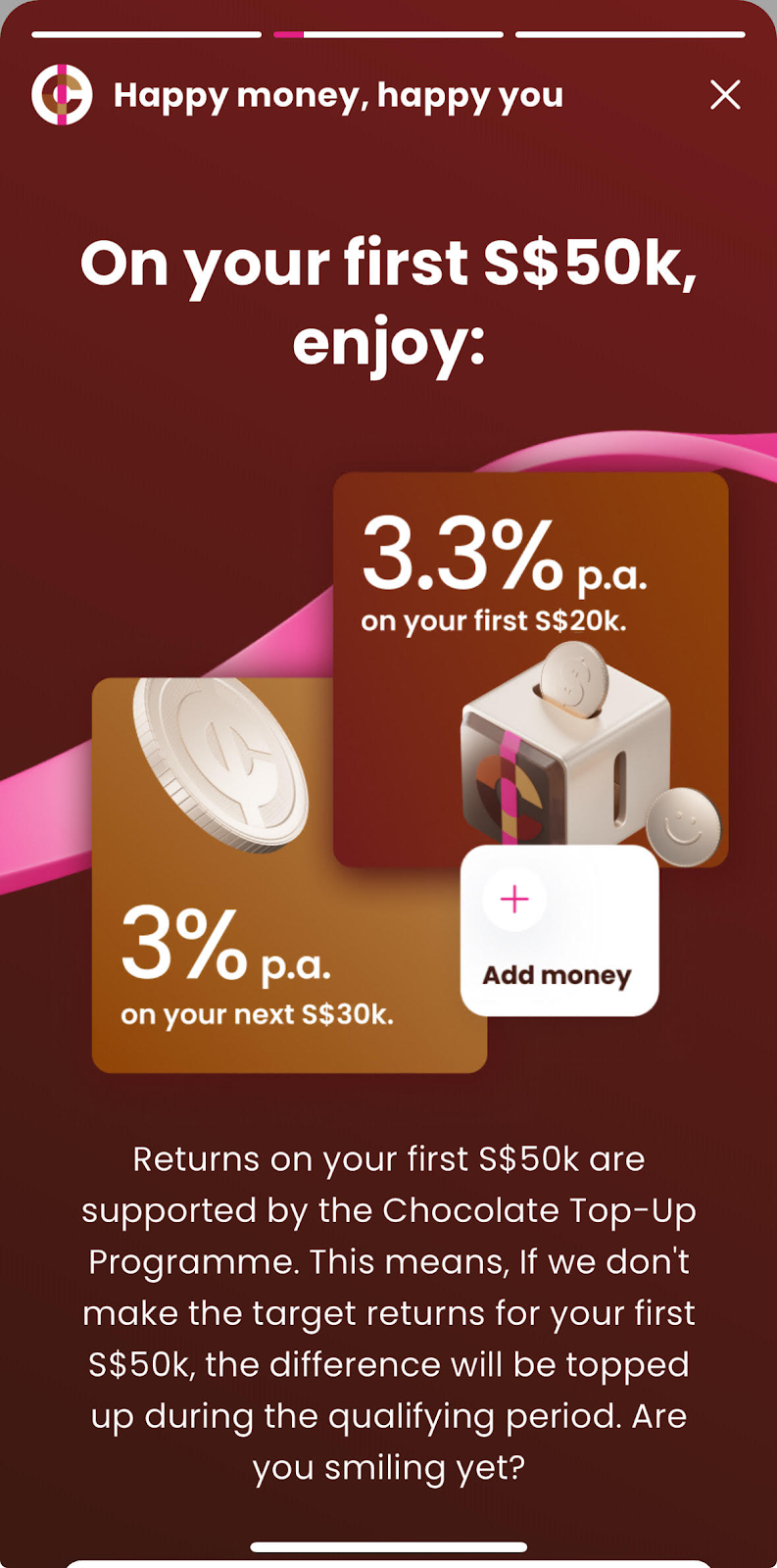

This month, I received a special income from a POSB/DBS fixed deposit @ 1.88% p.a that I signed last year. The amount? $188 (HUAT AH!). I'm looking out for other attractive fixed deposits. Let me know if you've any lobangs!

Other earnings came from:

- angbaos - not sure if this is the 2nd last time I'm getting this :'(

- interest - from OCBC 360

- credit card rebates

- dividend from my stocks (woohoo!)

Slight recoup of my variable expenses due to the angbao $$ and interest from fixed deposit and dividends from stocks. Hope I won't spend so much next month!

Hi Cherry,

ReplyDeleteUnlike you, budget wise, CNY tends to be a "painful" month. Not just the outflows from the ang baos, there's still the dinners and the new year goodies. But well, as long as we "budget" for it, there's nothing wrong with letting loose once in a while, right?

And congrats on finding Mr Right! Feel free to approach me if you need any "tips". My wedding to the Mrs wasn't that long ago...

HI FAV BLOGGER! Thanks! Have no plans for our wedding yet but will approach you for tips soon! :)

DeleteHI FAV BLOGGER! Thanks! Have no plans for our wedding yet but will approach you for tips soon! :)

Delete