PSA - Free staycation for $400 spend plus $50 credit?!

Fancy a free staycation at M Social Hotel and a $50 credit?

If you signed up for the FRANK credit card, you'll get the $50 rebate and receive a free staycation with $400 minimum spend.

The last I had a FRANK card was years ago. Back then (think 2012), FRANK account was suitable for undergraduates with their attractive interest rates and customised credit card designs. Their FRANK card was awesome as I recalled a 5% online rebates with low minimum spend.

As usual, good things don't last. When FRANK account offered pathetic interests compared to other salary crediting accounts and their FRANK credit card became unattractive due to it's minimum $400 offline spend to start clocking rebates, I cancelled it immediately.

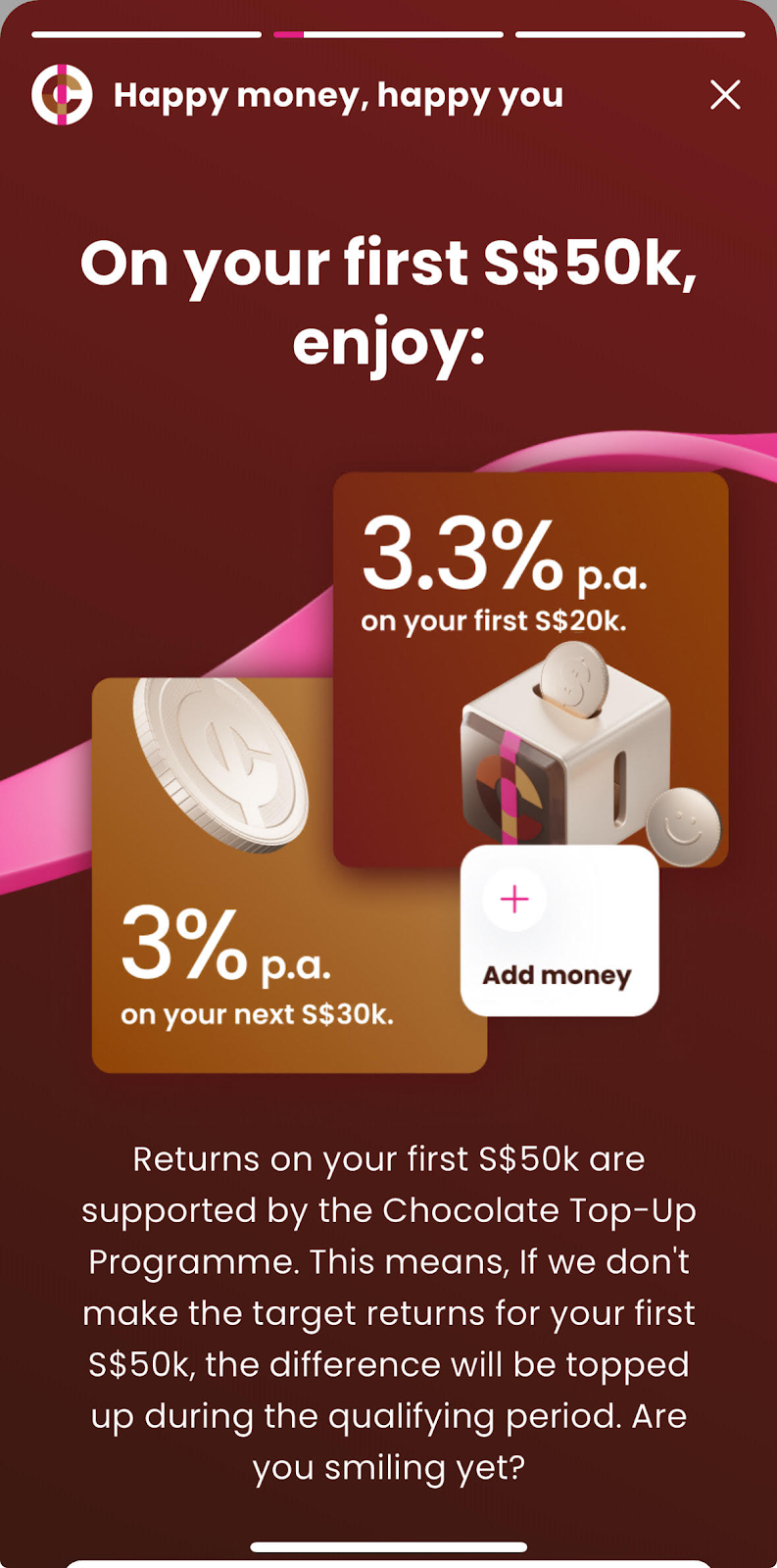

Until recently when I spotted this:

The credit card still sucks but by spending $400 for a free staycation? Count me in! Furthermore, I received a $50 credit by signing via myinfo which is effectively a 12.5% rebate!

Take note that the free stay is not the loft studio as they depict in their photo (so sneaky!), but the Alcove Cosy room. 1 night cost around $180 for a room without breakfast.

To be frank, I didn't had anything to clock for $400...so I actually used it for NTUC vouchers🤭My mom would berate me for this; nothing to buy, purposely spend money! HAHA

In any case, I've since received the letter informing me of my complimentary stay and can't wait to utilise it to celebrate milestones with my hubby!

As to whether I'll use this card again.....unless they revise their rebates, this card is going into cold storage! Shhhhh

Again, I'm not sponsored. Just sharing a deal, so DYODD!

Comments

Post a Comment

No rude messages please. Unkind messages and spams will be blocked and deleted.